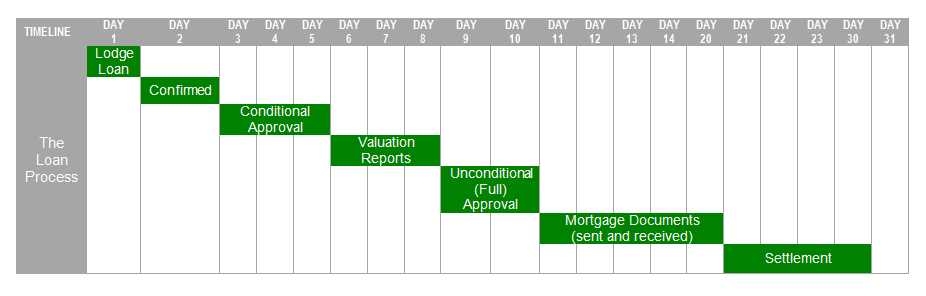

Loan Application Process

1. Interview

Your Imagine Home Loans broker will discuss your needs with you to ensure we select the most suitable product for you from our panel of over 30 lenders.

2. Loan Application Process

Takes 24-48 hours

Upon receiving all the required documentation, we will lodge your loan application with the lender. This includes the First Home Owners Grant (FHOG) where applicable. Please note on some occasions the lender cannot lodge the FHOG application on your behalf. Check with your broker for details. Once lodged, we will receive a confirmation receipt from the lender within 24 hours.

3. Conditional Approval

Takes 2-3 days

Once the loan is assessed, the lender will grant a conditional approval. This will detail any outstanding matters requiring attention prior to unconditional or full approval. Upon conditional approval, properly valuation/s will be ordered by the lender (if required).

4. Valuation Reports

Takes 3 days

This stage involves the property being valued. The valuation report/s will be received by the lender within 3 days of request (subject to property availability).

5. Unconditional Approval

Takes 2 days

Once all the conditions are met, we will receive unconditional approval. This means that a letter of offer can now be issued.

6. Mortgage Documents

Takes 5-10 days

The lender will forward to you a letter of offer and the associated mortgage documents. Don’t be alarmed by the amount of documents contained in this parcel. These are standard documents, and your Imagine Home Loans Broker is there to help you. Under normal circumstances, the lender will send a copy of the mortgage documents to you (or the nominated party) within 5 days of unconditional approval. You will need to sign the mortgage documents and return them to the lender within 5 days. Phone your Imagine Home Loans broker on receipt of your mortgage documents.

7. Loan Settlement

Takes 2-10 days

Purchasing Property

2-3 days after you have returned your mortgage documents your solicitor/conveyancer will contact the lender to book settlement. Your solicitor/conveyancer needs to allow 3-5 days prior to settlement to arrange the necessary paperwork.

Refinancing

2-3 days after you have returned your mortgage documents the lender will liaise directly with your existing lender (if different) to arrange your property finance. Your existing lender may require some time to prepare a discharge of their existing mortgage and arrange settlement. Your Imagine Home Loans broker will follow this up for you.

8. Settlement

Congratulations! Settlement has taken place and your loan is now finalised!